Opening a US Bank Account Online with Mercury: A Step-by-Step Guide

The process of opening a bank account remotely online for LLC company owners in the USA is now very simple. In general, the following problems are the biggest ones faced by international e-commerce businesses:

- Opening a business account in the United States for the company

- Failing to find debit cards to make purchases

- Not having access to reasonably priced international money transfers

- Plus a lot more.

To assist you in finding quick solutions to these problems, we have created a guide. If you have a business in the US and require a bank account, you can open one without flying there.

but how?

Let’s begin right away.

Is It Important to Open a Bank Account in the US?

Yes, It is important. You must have a bank account through which you can send and receive payments if you own a business in America and conduct business through it.

You must be able to save up your earnings somewhere, use bank cards to reinvest them as capital, and, most importantly, transfer them cheaply to the nation where you currently reside.

However, many platforms or marketplaces will demand a US bank account. The most notable instance is;

- eBay

- Stripe

- Amazon

- PayPal

- Etsy

- Shopify

- And many others.

You must first create a company in America and obtain an EIN before you can open an account on these platforms and start doing business.

Then, in order for these platforms to send payments to you, they will ask you for a US bank account number.

In conclusion, whether you like it or not, you have to open a bank account if your business conducts e-commerce in the United States.

How to Open a Bank Account in the US

To open an account at one of the physical banks in the United States for a company based there, you must travel to the nation.

Prior to recent changes, this task was simpler.

In this instance, many business owners felt let down and even made the decision to shut down their enterprises.

Digital banks have altered the landscape, though, and given non-American businesspeople new opportunities.

It used to be fairly simple to open a physical bank account in the US remotely over the internet, but things have changed a lot since the country’s security laws were updated.

Why is it so challenging to open a traditional bank account in the US?

The LLC owner must physically visit the bank in order to open an account with many traditional banks in the US. You can open an account in person at a bank with your EIN letter.

An Individual Taxpayer Identification Number (ITIN) and proof of address in the United States are required when opening an account with a major bank (bank specifics vary). You can get an ITIN number from this LINK if you need one.

Digital banks provided assistance to people who were unable to meet these requirements. With digital banking platforms like Mercury Bank and Wise, it is possible to open an account online.

These are insured financial institutions, not physical banks, but they might be adequate to support your trade or business.

There are actually seven companies besides Digital Bank that can assist your business in setting up a remote account in the US.

However, since Mercury Bank is the most well-known of these alternatives, we will concentrate on it in this article.

Mercury Bank: What is it? What Does It Provide?

To make it simpler for business owners to open a remote bank account, Mercury Bank, whose founders identify as entrepreneurs, launched in 2019.

In April 2019, Immad Akhund, Max Tagher, and Jason Zhang established Mercury Bank in America.

Entrepreneur Immad Akhund claims that this organization was established in order to close the gap and stop entrepreneurs from encountering the same issues with banks that they did.

Mercury Bank is a great convenience for people beginning a new job. These cards can be used to make purchases of goods and services online. a lovely card with your name and the name of your business on it. On the other hand, Mercury offers you some advantages.

Mercury Bank Advantages

- Checking and Savings accounts

- A savings that yields 1-2%

- Bank card (ATM/Debit)

- Internet banking

- ACH payments

- Check payments

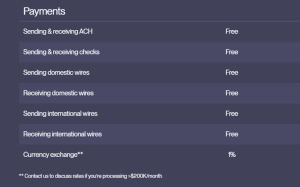

- Free domestic and international money transfers

- Useful tools to keep track of money

- FDIC insured deposits

- A free debit card for every user

- Opening an account remotely online

- Virtual card

- Teamwork

- No minimum balance

- No monthly fees

- And much more.

Mercury Bank Costs and Price

Opening an account with Mercury Bank is totally free. They don’t charge any additional fees; all you have to do to open an account is have an LLC company, claim that all of your clients are based in the US, and provide an EIN for your business.

You can send money from payment processors like Stripe to Mercury Bank even if your clients are not in the US.

However, don’t mention that your clients are outside of the US when opening an account; otherwise, your application might be turned down.

What kinds of businesses does Mercury Bank not accept?

You must first create an LLC and obtain an EIN from the IRS before you can open an account with Mercury Bank online.

We stress this at every chance because we frequently receive inquiries about opening personal accounts.

Mercury Bank does not consider individual applications. Entrepreneur-friendly Mercury Bank is opposed by some businesses. The following list of job categories is incomplete:

- Businesses that provide financial services or provide adult entertainment

- Marijuana or online gambling

- Additionally, they might feel that certain categories are inappropriate.

In conclusion, Mercury Bank readily accepts a wide range of businesses that follow the law.

Is a website necessary to open an account with Mercury Bank and Marketplace Store?

To open a Mercury bank account, you must supply a website or a marketplace link (social media account links may also be required). If you have no projects, you cannot open a Mercury bank account.

They will accept an English-language website that has been finished and complies with the rules. If you don’t have a website, you can provide a link to your eBay, Amazon or Etsy store, among other places. You must own the stores, and they must be stocked with live merchandise.

When submitting an application via the website, if possible, create an account with a unique e-mail address for your domain name.

To sum up, in order to open an account, you must have an e-commerce website or, at the very least, sell products from international brands on marketplaces.

Declaring that your primary source of income is from the United States is the most crucial thing to keep in mind when opening a Mercury bank account.

Emphasize this in your responses during account opening to prevent issues with account approval.

What Document Is Necessary to Open an Account at Mercury Bank?

You must be a US-based business with an Employer Identification Number (EIN) in order to open an account with Mercury Bank. However, you must also submit your passport, the documents proving your company’s incorporation, and the EIN approval letter.

Additionally, you must enter your home address rather than your business address when opening an account in your own country, and you must submit documentation of your residency in the form of an invoice or bank statement. Now they want the home address of the owner of the LLC company, not the registered agent address.

When opening an account, there are systems in place that allow you to verify your passport online or through a mobile application. Don’t be hesitant to launch your own company.

In a short amount of time and for a reasonable price, a company can be established in the US. On our website, you can find information about forming a company.

Is there a Mercury Bank debit card program?

Yes, each and every Mercury member is given a free debit card. Virtual cards are also supported, and they can be made right away. Mercury will send a free debit card to your country of residence once your account has been established.

How Do I Open an Online Mercury Bank Account?

Once your LLC company is established, this is fairly easy. (If you don’t have one, just get in touch with us, and we’ll walk you through the steps.)

Go to mercury.com and register by clicking the “Open Account” button if everything is in order.

Note: If you join through the Welpepy link, a $250 gift balance will be added to your account after you deposit a certain amount.

Conclusion

For business owners who are launching a new venture and reside outside of the United States, Mercury Bank is an excellent choice.

It is unmatched in this industry due to its ability to open a remote account, freedom from fees, availability of free transfers, debit card, and lack of onerous procedures.

You can immediately set up an LLC company and start taking advantage of Mercury Bank’s services if you are already engaged in e-commerce or online commerce in another nation, or if you plan to expand into the international market and start an online business.